Welcome to our comprehensive guide on the top 30 online platforms in Australia for affordable individual tax returns! Tax season can be a stressful time for many, but fear not, as we have scoured the web to bring you a curated list of the best online services that offer cost-effective solutions for your tax needs.

In this digital age, the convenience of filing taxes online has become increasingly popular, and with so many options available, it can be overwhelming to choose the right platform that suits both your financial requirements and ease of use. That's where our list comes in handy – we've done the research for you, narrowing down the choices to the top 30, ensuring they are reliable, secure, and most importantly, budget-friendly.

Whether you are a freelancer, a part-time worker, a student, or just someone with a simple tax situation, these platforms cater to various individual tax scenarios, making it easy to navigate through the complexities of the Australian tax system. From user-friendly interfaces to expert assistance, you'll find a diverse range of features that cater to different preferences and needs.

Join us as we delve into the world of cheap individual tax returns online in Australia and discover how these platforms can simplify the process, maximize your deductions, and potentially lead to a stress-free tax-filing experience. So, let's dive in and find the perfect online tax filing solution for you!

Ultimate List Of Cheap Individual Tax Returns Online Australia

Tax Window- Cheap Individual Tax Returns Online Australia

0401 117 311

Tax Window employs an award-winning approach to taxation, setting them apart from typical accounting firms. Their comprehensive services extend beyond the scope of traditional tax agents, offering expertise in various financial areas such as investment accounting and business enhancement.

Unlike many tax agents who charge exorbitant fees for their services, Tax Window takes a different approach. They believe in simplifying the taxation process, providing clients with understandable solutions that are tailored to their specific needs. Moreover, Tax Window stands out by offering industry-leading fees for its exceptional services.

One of the key aspects of Tax Window's service is its focus on delivering personalised tax strategies to each client. As a boutique tax practice, their team of tax agents pays special attention to individual clients, ensuring that their tax strategies are carefully crafted to minimise tax payments.

For those seeking investment planning assistance, Tax Window is a reliable partner. They possess unique insights into the Australian tax code, allowing them to develop strategies that keep their clients ahead in the financial game.

Business owners can also benefit significantly from Tax Window's expertise. The team understands the challenges of managing a business and the burden of compliance-related tasks. By entrusting Tax Window with their accounting and taxation needs, entrepreneurs can free themselves from the hassle of number crunching and focus on the growth and success of their ventures.

Tax Window's award-winning approach to taxation goes beyond the norm, offering exceptional services that cater to the diverse financial needs of its clients. Their dedication to providing understandable solutions at competitive fees sets them apart as a reliable and trusted partner in the complex world of taxation and financial management.

Tax Warehouse - Cheap Individual Tax Returns Online Australia

0407 418 209

You Can Trust Online Tax Accountants in Australia

Do you detest completing your taxes each year? So you are not required to any longer! Because we handle it for you, Tax Warehouse makes filing your tax return simpler than ever! Our service is quick and simple to use; you may select a qualified tax agent online and get your tax refund filled out and processed as quickly as possible, all while using your smartphone. The tax experts at Tax Warehouse will submit your online tax return on your behalf. Their history of claiming the biggest tax breaks and getting the biggest tax refunds possible in your sector. By ensuring that fully trained and authorized tax professionals handle your return, we provide you piece of mind. So you don't have to dread tax season and can start using your tax refund money sooner, we maximize your return amounts while minimizing your effort! You can electronically file your 2022 tax return with the aid of a competent tax advisor. You could complete your application in a few minutes.

What can you anticipate from our online tax agent services?

No matter who you are or what sector you operate in, our online tax advice is customized for you. We provide services to everyone who must file an Australian Tax Return, including building and trades contractors, individuals, business and creative professionals, retail staff, agricultural laborers, school teachers, office staff, social workers, and anybody else. Whether you are in Adelaide, Mildura, Melbourne, Sydney, Brisbane, Perth, Darwin, Gold Coast, Cairns, Townsville, Hobart, Shepparton, Swan Hill, Portland, Sale, Toowoomba, Broome, or anywhere else in Australia, our online tax accountants can help you maximize your return. The tax warehouse also knows which tax deductions you are eligible for. You will always get a terrific tax refund thanks to this. You don't need to be an expert in taxes because our agents are. However, we can address any questions you may have about maximizing your tax refund. Our costs are tax deductible, and there are no additional fees. You can choose to pay $121 ahead or deduct $143 on your tax return, for instance. There is no need for a drawn-out process when filing your taxes. You may complete our straightforward steps in just a few minutes using our online tax return service. Everything from Mildura to Adelaide, Hobart to Darwin, Perth to Brisbane. You don't have to hold your breath. Your tax refund will be transferred into your bank account within 10 to 14 days. Just how filing your tax return should be, our procedure is quick and simple. We promise a maximum refund on your tax return. Our tax experts will review your industry to make sure you've taken advantage of all allowable deductions. To support your claim, you must be able to present receipts or invoices. On our list, there aren't many challenging queries. The process of filling out our online application is simple and only takes a few minutes. Leave the rest to Tax Warehouse by completing our online tax return form at www.taxwarehouse.com.au/get-refund/.

Hrblock - Cheap Individual Tax Returns Online Australia

13 23 54

Your Tax Return

We specialize in minimizing complexity in tax returns. We provide a convenient option for you regardless of when, where, or how you want to do it because we have over 400 offices and have been Australia's top tax experts for more than 50 years.

ITP Accounting Professionals - Cheap Individual Tax Returns Online Australia

1800 367 445

If you want to learn more about income taxes or pursue a rewarding profession as a tax adviser, the ITP Income Tax Course might be right for you. What results from your tax return should you expect? Utilize our tax return calculator to estimate your tax refund.

Whether it's for one day or five days a week, we'll tailor our service to your needs. Profit from the experience of people who are knowledgeable about a variety of industries and can offer guidance targeted to your particular need.

Individual Tax Returns FAQs

$12,950

For 2021, the standard deduction is $12,550 for single filers and $25,100 for married couples filing jointly. For 2022, it is $12,950 for singles and $25,900 for married couples.

$1,400

Taxpayers who are at least 65 years old or blind will be able to claim an additional 2022 standard deduction of $1,400 ($1,750 if using the single or head of household filing status). If you're both 65 and blind, the additional deduction amount will be doubled.

If you are age 65 or older, your standard deduction increases by $1,750 if you file as Single or Head of Household. If you are legally blind, your standard deduction increases by $1,750 as well. If you are Married Filing Jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,400.

WASHINGTON — The Internal Revenue Service announced that the nation's tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

Most people age 70 are retired and, therefore, do not have any income to tax. Common sources of retiree income are Social Security and pensions, but it requires significant planning prior to the taxpayer turning age 70 in order to not have to pay federal income taxes.

Tax Return - Cheap Individual Tax Returns Online Australia

0499 829 845

Australia's Tax Guides

To make tax season less stressful and prevent specific mistakes, we believe that everyone should be aware of its subtleties. Our ABN Guide will provide you all the information you need, whether you're a single trader with experience or a fresh, budding freelancer searching for help on how to get your ABN. We want to help you because we know how challenging owning your own business can be. We'll go over how to get an ABN, submit expense claims, file taxes, and more. These tips will help you file your taxes less stressfully, but they will also help you handle and manage your finances more easily in the long run.

A young family may make your financial situation more difficult by raising your expenses and altering your taxes. TaxReturn.com.au is aware of how challenging the tax system can be for a working family, which is why we've provided this useful guidance. We'll inform you of taxable family income, available benefits, if you qualify for government payments, and a variety of additional tax advice to help you and your family. We want to help you prepare your taxes as easily as possible since we all want to spend more time with our families. This will allow you to spend less time crunching numbers and more time with the people who matter to you.

Etax Accountants - Cheap Individual Tax Returns Online Australia

1300 693 845

Consider what you mentioned the previous year: It saves time and aids in keeping track of appropriate deductions. You can contact a qualified accountant by phone or live chat. Low pricing, no appointments necessary, no need to visit the tax office, and you still receive professional advice and verification. Etax Accountants verified correctness and looked for additional deductions (better support and service than many tax agent offices). Etax is there for you. You don't have to go it alone if you have the ATO.

Most people do their 2022 tax returns in a matter of minutes! How?Here are a few ways that Etax can assist you in completing your tax return quickly and with the confidence that it was done correctly. When you need them, you can get in touch with reputable, knowledgeable accountants. Your income or tax deductions may be the subject of a question. When completing your tax return, you can speak live with a helpful accountant.

Ezy Tax Back - Cheap Individual Tax Returns Online Australia

Simple: We guarantee a maximum refund whether you sign up for our quick online tax return lodgement service, our annual service, or a one-time service. Our CPA accountants will begin processing your return once you have submitted your form. To make sure we're getting the most out of your legitimate tax deductions, they'll double-check your information and ask questions. Filing for a tax refund is now simpler than ever. To get you started, we've created an easy-to-use tax refund tool. Australia residents can use our free online tax refund estimator at any time.

It now provides you with an estimate of your tax refund! Neither registration nor a credit card are required. You must complete the form in order to receive an estimate. You may view your potential return quickly and easily with the help of this tool. Therefore, we can help you if you work in Australia and need to file a tax return. You can register right away or once your tax estimate is complete. Our team will work with you after you file your initial online tax return to make sure you haven't missed any deductions.

Taxopia - Cheap Individual Tax Returns Online Australia

1300 829 674

The Taxopia team has more than 40 years of expertise providing business accounting and consulting services in a professional capacity. With complete public practice accreditation, registered tax agents, and ASIC agents, we are a forward-thinking accounting firm. For publications like the Australian Financial Review, BRW, and the Flying Solo Small Business Forum, we have authored tax and business pieces.

Tens of thousands of business tax reports, business activity statements, corporate tax returns, and trust tax returns have been received. Our products are of the highest quality and offer exceptional value to Australian small and microbusinesses. We are based in Melbourne and serve the entire country.

Therefore, Taxopia provides a fantastic tax accountant solution for you whether your firm is headquartered in Brisbane, Sydney, Perth, Adelaide, Melbourne, or anywhere in between. Assistance with tax minimization and the tax status for the tax year(s) for which the service is being supplied from a dedicated accountant and tax counselor.

Astro Accountants - Cheap Individual Tax Returns Online Australia

07 3180 3145

Our goal is to make people's lives happier by lowering financial stress, boosting financial literacy, and assisting them in making wiser financial decisions. Everything we do is based on this premise. The staff at Astro is committed to helping individuals become more skilled money managers, both in business and as investors. We believe that having financial security makes it easier for you to help others, share your expertise, and live your best life. Tax returns and advice.

One of your biggest expenses is taxes, and missing a deadline could have a disastrous effect on your financial situation. Businesses, trusts, SMSFs, and property owners can all benefit from our strategic advice. We can help you reorganize your affairs so that you can satisfy your ATO obligations, minimize risks, and pay less tax. To ensure that you reach your deadlines, our staff will keep you updated and on track. Additionally, we offer software that can extract the data from your deductions and preserve it online for easy access whenever you need it.

Maurer Tax - Cheap Individual Tax Returns Online Australia

0438 960 945

Returns four times in a row. Tax accountants that are helpful and friendly efficiently prepare and file tax returns. If you file on the same day as your tax return, your refund will come sooner. It is possible to access returns for individuals, ABNs, partnerships, corporations, and trusts.

Consultation and support sessions to address any of your tax-related questions. Examples of creating an entity include registering for an ABN, registering for GST, and forming a business, partnership, or trust.

Don't allow large accounting firms reduce you to a number. Instead, work with experts that genuinely care about you to obtain the tax help you require at a fair price.

Mulcahy & Co - Cheap Individual Tax Returns Online Australia

1300 204 745

We have provided businesses, farmers, wage and salary workers, and retirees with specialized and personalized services for more than 20 years. Your one-stop shop for marketing, loans and financing, accounting, tax preparation, and financial planning is Mulcahy & Co.

East Partners - Cheap Individual Tax Returns Online Australia

(08) 8362 3445

When using cloud accounting, we utilize the same real-time financial information that you do. By selecting the right business structure, you may preserve your company's assets and maximize tax benefits. Nobody enjoys paying their taxes in excess. Therefore, in addition to planning, we help you maximize any tax benefits to which you may be entitled. To ensure you receive the best advice possible, our team of SMSF professionals only uses the most recent information. We'll help you make cash flow projections and budgets so you won't be caught off guard. After a long day at the office, most of us don't want to do anything tiresome like bookkeeping.

Are you tired of conflict within your company? Do you want to raise your business's profitability, cash flow, and regain the balance in your life? You can work with East Partners to improve the direction and profitability of your company. We are situated in Adelaide and service clients all throughout Australia, and we are dedicated to giving you this. We collaborate with you to grow your money and your business. We can also offer you professional advice on finances and business.

Q-Tax - Cheap Individual Tax Returns Online Australia

1300 047 845

If you're a high school student, we'll take care of your tax return (under 18 years old). For just $69 for your first tax return, our tax advisors are honing their skills to help you earn the biggest possible tax refund. If you work part-time and perform labor in the hospitality/retail industry or when picking fruit, you can be entitled to a tax return.

Your Reply and Further We don't merely leave it parked and unattended. Of course, tax season is when we shine, but we're also accessible all year to help students with things like comprehending the tax repercussions of part-time employment. We're putting what we've learned to work for you as you're learning new things.

Tax Effective - Cheap Individual Tax Returns Online Australia

1300 399 845

Hire an experienced tax accountant online to prepare your tax returns without leaving your house. Our tax accountants will provide you with an online video consultation at your convenience. Get the biggest tax refund possible, as well as sound tax advice, which could result in tens of thousands of dollars in annual tax savings.

We comprehend. You have a ton to do every day, yet for some reason you can't make it to your accountant's office to file your taxes. Combine the convenience of not needing to go to the office with the assurance that a professional is handling your tax return. We'll handle everything whether you're at home, at work, or on the go. Learn about efficient tax strategies and structures to reduce your taxes, boost your cash flow, and increase your wealth.

Sydney CBD Premium Tax Returns

Are you looking for an accountant that can maximize your tax return and provide you with tried-and-true strategies for legally and significantly reducing your tax bill? Sydney's most well-liked tax return preparation service is called Tax Effective. You may manage your finances and prepare for retirement with a self-managed super fund.

A1 Accountants - Cheap Individual Tax Returns Online Australia

03-86091845

MELBOURNE TAX ACCOUNTANT

We are a team of tax accountants with vast experience in both personal and business tax accounting across a range of industries. With degrees from Australian institutions, our tax consultants and accountants are motivated and eager to help you with your tax-related problems. To stay up to date with rules and customer expectations, they undergo rigorous and continual training. We are a team of Xero and Quickbooks certified tax accountants in Melbourne.

TAX RETURNS ONLINE IN MELBOURNE & ACROSS AUSTRALIA:

Accountants and tax agents can now gather and prefill most of the components of the Australian tax return because of the ATO's improved data matching techniques. Data from the Australian Taxation Office, banks, Centrelink, service and educational providers, customers of share trading platforms, and information from other governmental and non-governmental organizations all contributed to making this possible. Thanks to advances in technology and easy access to information, completing online tax returns is now easier than ever. You and your accountant are free to file your tax returns from anywhere in Australia as long as you have the very minimal information that we ask for.

Beyond Accountancy - Cheap Individual Tax Returns Online Australia

1300 823 045

We collaborate with you to identify ways to make your tax problems simpler and provide proactive advice to help you make the most of your predicament. We are aware that paying taxes might be difficult. As a result, we offer flexible appointment times and exclusive online consultations. One should not ignore sound advise. We offer proactive advice to assist you improve your financial situation.

We are experts on tax laws; you are not. We keep you informed about the information you must have and the appropriate times to have it. You can put your taxes in the rearview mirror with the reliable tax return services Melbourne residents trust. We offer more than just tax return preparation, in contrast to many Melbourne tax accountants.

In order to improve your financial condition and guarantee that you get the most out of your tax return, we go above and beyond to offer strategic tax solutions. We never skimp on quality; instead, we streamline our processes to give our tax return accountants more time to offer knowledgeable advice that adds value.

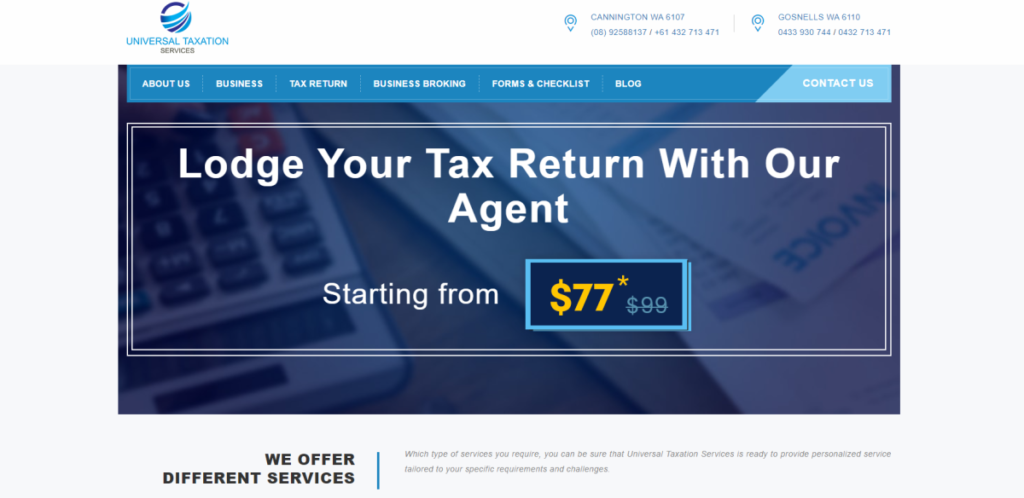

Universal Taxation - Cheap Individual Tax Returns Online Australia

0433 930 755

Do you want the best tax returns Perth has to offer? With seasoned tax return specialists like Universal Taxation on your side, you can be confident that you'll get the biggest refunds and the quickest settlements possible! Our accounting team at Universal Taxation is experienced and well-known for putting in significant effort to ensure that you consistently receive the best reimbursements.

We at Universal Taxation promise to provide you and your company with excellent services. Contact us right away to learn more about how we can assist you with all of your tax filing needs in Perth. A failure to lodge (FTL) on time penalty is imposed when a return or statement is not filed within a certain amount of time. A small entity faces a fine of one penalty unit ($210) for each additional 28 days that the filing is late, up to a maximum of five penalty units ($1050).

The fine is quadrupled for businesses with turnovers of between $1 million and $20 million. Large entities are required to pay five times as much when their assessable income exceeds $20 million. Using an automatic penalty system, FTL penalties are applied to all returns and statements, such as activity statements, income tax returns, PAYG withholding annual reports, payment annual reports, and the like.

The Tax Shop - Cheap Individual Tax Returns Online Australia

1300 131 945

The fact that we have filed well over 500 000 income tax returns speaks for itself as to why so many Australians insist that "The Tax Shop" is the only place to go when it comes to filing taxes. Our vast industry knowledge guarantees that our clients receive the most comprehensive continuing support. With a national workforce of more than 100 employees, we are large enough to handle things yet small enough to care. We treasure our autonomy. This makes sure you can rely on support and advice that is fiercely independent of all other banks and financial service providers.

You may rely on guidance that is always frank and objective in all aspects. The Tax Shop / Tax Refund Centre is the firm for you if having a long-lasting, productive partnership with a public accounting business is important to you. We invite you to schedule a meeting with a member of our welcoming staff to learn more about the solutions we can provide.

One Stop Tax - Cheap Individual Tax Returns Online Australia

(02) 8373 5945

Our accounting practice is organized to meet the needs of your business. From self-assessment tax filings to challenging consulting projects and tactical tax planning, we provide a broad range of services to corporations, partnerships, trusts, and individuals. The following areas also offer professional services: Individuals, corporations, and small enterprises can all benefit from tax advice.

Advice on reconstruction and reorganization. Assistance with GST, FBT, PAYG, and IAS making the most of tax deductions and exemptions (e.g. Research & Development tax credits, various capital allowances reliefs etc.). preparing for foreign taxation. Income tax and capital gains tax. Tax audits and dispute resolution by the ATO.

Every Budget introduces new tax legislation, and forms get trickier. The Australian Taxation Office imposes severe penalties in an effort to increase compliance. The key to managing your compliance requirements and reducing your burden is understanding the implications of tax legislation and collaborating with qualified tax experts to plan appropriately.

New-Wave - Cheap Individual Tax Returns Online Australia

(07) 55041945

Any business that has reported its taxes for at least a year. Business owners that want a second perspective because they think they are paying taxes too much Businesses who have gone through a capital gains tax event, like selling an asset or a business, want to know whether there is anything they can change to save money. Organizations that file payroll taxes.

Where would your business be if it could save an additional $10,000, $20,000, $50,000, or even $100,000 in taxes annually? You may invest this money in marketing, recruiting more staff, or even raising your pay in recognition of the years of devoted effort you've put in. You would be able to relieve a significant burden from your shoulders in terms of financial security, and you would finally feel like your business was growing. These are just a few instances of satisfied clients. We'd want to help you join them by giving you our support.

Online Tax Australia - Cheap Individual Tax Returns Online Australia

(03) 9852 9045

It's not surprising that Online Tax Australia has completed over 45,000 tax returns after promising to provide the best possible customer service and reasonable, timely tax returns. Our top priority is to give you complete peace of mind regarding all of your tax return needs. The review procedure that all tax returns go through has undergone substantial changes as of 2018 thanks to the Australian Taxation Office (ATO). These changes have made it more important than ever for taxpayers to check the correctness of their tax returns. The comprehensive services offered by OTA give you all the tools you need to complete and file an accurate tax return.

For an additional $10, you can use Online Tax Australia's Premium Pre-Fill Service to make the tax return process even simpler and faster. With the help of our Premium service, Online Tax Australia will handle the time-consuming task of finding and entering all necessary information accessible through the myGov portal. Included are PAYG, interest, dividends, Centrelink data, HECS/HELP, and more. Now you just need to add your information and tax deductions. As a result, we make the already simple process of submitting your tax return even simpler and less stressful when you use our Premium Pre-Fill Service.

Tax Today - Cheap Individual Tax Returns Online Australia

1300 829 845

At Tax Today, you may get a professionally prepared tax return and get your refund right away. This could come in the form of a check that can be cashed or a quick direct deposit into your account. Because of this, we are called Tax Today. Most refunds are sent when your tax return is submitted. That moves almost as quickly as an ATM. As a result, call 1300-829-863 immediately away to reach the branch that is closest to you. We offer incredibly quick online refunds for people who are unable to come into our offices. Just complete our online form or give us a call, and we'll handle your refund typically within 3-5 business days.

You may calculate your tax refund using our free online calculator. This most current fiscal year, which concluded on June 30, is covered by this tool's most recent tax calculations. This is for the tax return for the current year. Although it is only an estimate, this calculation is the same as how the ATO determines your refund.

Express Tax Back - Cheap Individual Tax Returns Online Australia

1800 739 739

After 25 years of providing tax back services to travelers and those with working visas, we have developed a successful "Tax Back System." For backpackers, travelers, and students, the tax refund technique was developed to guarantee the highest tax refund in the shortest amount of time.

Australia's first tax refund company specializes in tax refunds for travelers, people with work visas, and foreign students. We are now the sole tax and super DASP claims experts in Australia. Our tax refund process is quite novel and unconventional. It is based on a deep knowledge of both domestic and foreign tax law. People have said that we possess a "WOW" factor. Get your refund as quickly as you can.

Cst Tax - Cheap Individual Tax Returns Online Australia

61 2 8920 0045

Individuals with worldwide interests need specialized international tax knowledge when preparing their personal tax returns. You must be truthful in your statements and aware of your obligations. For Australians living abroad, expats in Australia, and Australians with assets abroad, we specialize in creating personal tax returns. Those with international interests must prepare their tax returns using specialized tax knowledge. Our accounting team includes foreign tax experts with the knowledge and skills to handle even the most difficult international tax situations.

Australians who live abroad but still have assets and investments there need to be sure they're taking care of their tax duties there. We assist by making sure your annual compliance requirements are satisfied. We assist expats in managing their tax obligations in Australia who have assets abroad.

As a result, clients who become clients of our offices in the United States, the United Kingdom, or Singapore can take advantage of our integrated tax services. Australians with assets abroad will have additional tax obligations. To assure adherence to these standards, we provide our knowledge in international tax.

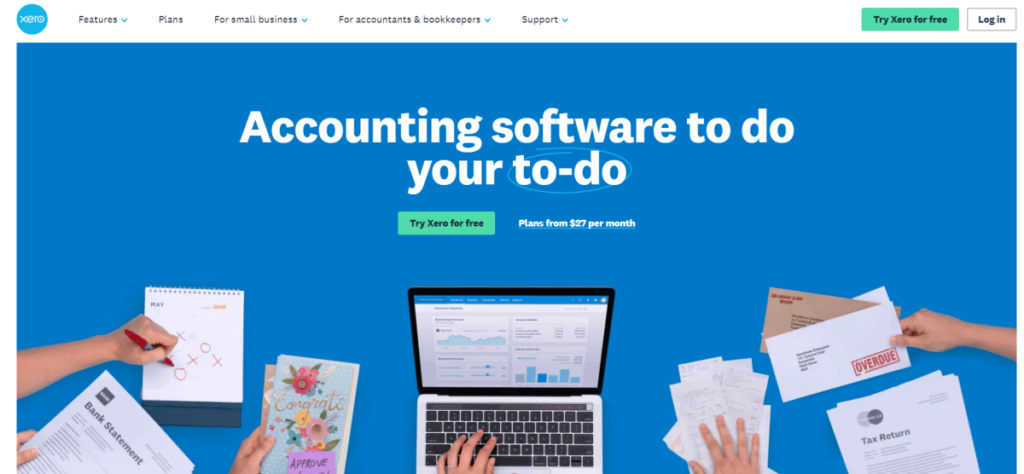

Xero - Cheap Individual Tax Returns Online Australia

From 2014 on, Xero Tax should only be used to create and submit returns. Yearly updates and new additions to the tax form library are made. It is possible to electronically file Xero Tax schedules and forms. 1000 tax returns can be filed monthly.

A secure data exchange between your workplace and the ATO can aid in your productivity. Pre-fill activity statements with data from the ATO automatically or manually. Fill in a client's income and deductions on individual tax returns automatically. Update the ATO client.

The Kalculators - Cheap Individual Tax Returns Online Australia

(08) 7480 2545

We make filing taxes simple. For as low as $60, we will assist you with regaining control over your personal or corporate tax filings. The rest will be handled by us after you schedule a consultation at one of our seven convenient South Australian locations. There aren't any difficult forms to complete. The largest refunds only.

Low-cost tax returns Residents in Adelaide may rely on

For as low as $60, we can help you take charge of your personal, trust, or business tax returns, even if they are overdue. We make filing taxes simple. In a complex climate with ongoing legislative changes, our team of skilled tax accountants can help you register your corporate tax returns and better understand your past and future individual tax obligations. Additionally, we offer our clients friendly, frank, and succinct tax consultations and make proactive recommendations to improve their financial situation.

Bc Accountants - Cheap Individual Tax Returns Online Australia

For both corporations and individuals, quick online tax returns, financials, counseling, and other services are available. For more than 25 years, experts have offered the most affordable flat rates. Simply select your form from the list below, fill it out, and submit it online. our method. We start working as soon as you submit our online form.

Then, for individual returns, we will get in touch with you if we need more details. Examine the system balances and status, as well as your ATO pre-fill reports. You will receive a copy of the return through email. Please check in by the next morning if we don't hear from you. For financial gains, we will. If more details are needed, we'll get in touch with you.

Check the status of your ATO accounts as well as any prior refunds. any additional obligations or alterations that could be necessary. Produce reports or financials to ensure accounting and tax compliance. Prepare returns and submit them all for approval. As soon as we have signed copies, you can lodge online.

Austax Tsv - Cheap Individual Tax Returns Online Australia

07 4725 2345

Regardless of who you are, what you do, or where you hold a job, we make it simple for you. Our knowledgeable and skilled professionals are committed to relieving your concern about meeting your tax obligations and attaining the finest result. In North Queensland, we are the biggest individual tax return preparers.

Burford - Cheap Individual Tax Returns Online Australia

08 8271 4045

Accountant, Tax Agent, and Business Advisor in Adelaide

Your expectations for our level of service will be met or surpassed. We'll address your case in a professional, effective, and sympathetic manner. No matter how difficult your return is, how old it is, or how optimistic or pessimistic you are about your circumstance, we will help you.

For you, we prepare and file tax returns. We prepare and file returns for various types of entities, including people, companies, partnerships, corporations, and trusts. Do you have to submit several tax returns? There aren't any. Expat or non-resident? We are here to help. Problems with managed funds, rental properties, or CGT? We can help you with these as well. No matter how straightforward or complicated your return is, we can help you have a less taxing tax season.

Numberwise - Cheap Individual Tax Returns Online Australia

1300 936 656

Numberwise provides complete accounting solutions to both enterprises and individuals. With our specialized, individual, client-centric approach, capable staff, and more than thirty years of expertise, it's clear why we're the accounting partner of choice. We prioritize our clients' needs above everything else, and we can demonstrate this for you. To find out more about working with numberwise, get in touch with us.

Get in touch with a numberwise tax professional; we have a team of knowledgeable tax professionals who will take the time to understand your needs and goals for your personal or professional life. Our connection with our clients is based on an in-depth discovery process, which enables proactive and progressive tax planning.

We begin by getting to know our clients. Then, we offer year-round tax preparation that takes into account your professional and personal goals. This enables important decisions that support your objectives to be made in real time. In order to minimize unpleasant surprises during tax season, we want to identify potential issues early and adjust.

![Top 25 Epoxy Flooring & Coating Companies Melbourne, Victoria [2022]](https://www.omnimelbourne.com.au/wp-content/uploads/OMNIMELB-Epoxy-Flooring-1024x683.jpg)

![30+ Best Standing Up Office Desks in Australia [2022]](https://www.omnimelbourne.com.au/wp-content/uploads/OMNIMELB-Best-Standing-Up-Office-Desks-in-Australia-1024x677.jpg)

![30+ Best Design Agencies Melbourne, Victoria [2022]](https://www.omnimelbourne.com.au/wp-content/uploads/OMNI-MELB-Best-Design-Agencies-Melbourne-1024x677.jpg)